Contents:

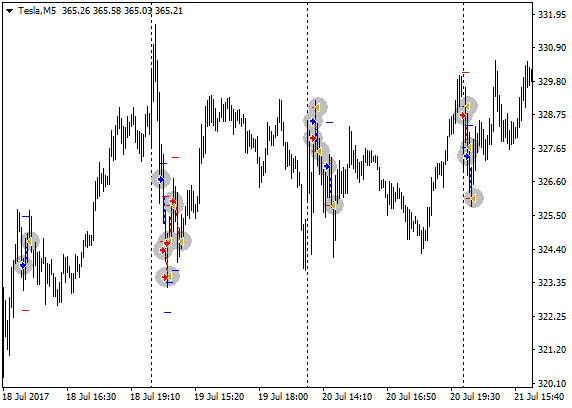

A line chart helps cut through the noise and offers a brief overview of where the price has been. They are particularly useful when drawing trend lines because they hide all the trading noise. However, you wouldn’t want to base your investment decisions solely on this data as essential information is missing. This activity counts as two day trades because there are two changes in directions from buys to sells.

- The upper and lower boundaries of this range should represent levels where the stock has been historically overbought or oversold, respectively.

- A working knowledge of technical analysis and chart reading is a good start.

- They are common, but won’t occur every day in every investment.

- After that, we can clearly see the consolidation period—prices vary, rising and falling, but not by much.

- These higher highs and higher lows create support and resistance levels.

On top of that, you get access to indicators with alerts and several intelligent drawing tools on TradeStation. A Kagi chart needs the reversal amount you specify in percentage or price change. Then, the chart changes direction once the price turns in the opposite direction by the pre-determined reversal amount.

Weaknesses of the Late Day Consolidation Pattern

Each candlestick gives you distinct pieces of information about how the stock or ETF behaved during that time frame. The skinny part of the candle is known as the “wick,” and it shows you the highest and lowest prices reached while the candle was forming. The thick part of the candle is called the “body.” The left side of the body shows you where the price opened, and the right side shows you where the candle closed. Candles may be color-coded to show whether the price closed above or below the open. As traders, we can never predict price action with absolute certainty.

To trade a Bullish ABC pattern, wait for confirmation of a reversal at point C. Once you have a close of the first green candle reversing off C you have confirmation of the reversal. A Bullish ABC Trading Pattern forms when the market is in an upward trend. When the trend lines near a meeting point volume increases and creates a breakout. Trading patterns are a common shape or combination of lines formed when tracing price movements.

You can also have triple or quadruple tops and bottoms, simply more confirmation of a support or resistance level. Second, it’s provides you with a logical spot to place your stop loss order, below the swing low. In the above bullish pennant you can see once again we have an initial uptrend followed by a period of consolidation.

Bullish Hammer

This chart pattern can also act as a trend reversal pattern. It depends on the location either it forms during a bullish trend or begins at the end of the bearish trend. If you want to learn more about market structure and using trading patterns on charts to identify trades join TRADEPRO academy.

Is USDJ (USDJ) Heading the Right Direction Saturday? – InvestorsObserver

Is USDJ (USDJ) Heading the Right Direction Saturday?.

Posted: Sat, 15 Apr 2023 13:20:01 GMT [source]

In addition, the article discussed Day trading patterns strategies for some patterns, which were tried in practice. Some time later, the trade closed intraday with a profit of 6.52 dollars. After analyzing the 15-minute GBPUSD chart, I identified the formation of the falling wedge, from which a breakout of quotes was expected. In the 15 minute XRPUSD chart below, you can see an illustration of a bullish and bearish pennant. The bears made an attempt to break through the lower border of the triangle, however, the bulls repelled the attack, thus forming a bearish trap of candle squeeze.

Day Trading Strategies

The pattern forms after a downtrend and completes on a reversal of the second bottom making a W shape. The high reached in the middle of the W becomes a resistance level. These two trend lines will begin to merge toward each other in a wedge shape. The entry will be found when there is confirmation of the breakout of the resistance level.

Like everything else with trading, the more you can focus your attention on one or two areas, the higher the likelihood you will have of success. A day trader may find a stock attractive if it moves a lot during the day. That could happen for a number of different reasons, including an earnings report, investor sentiment, or even general economic or company news. It’s often challenging to turn a profit as the day progresses, so it’s probably no surprise to learn that perfecting this trading pattern is no easy feat. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close.

If you’re flagged as a pattern day trader, you’ll need at least $25,000 in your account. A trader is classed as a pattern day trader if they execute a certain number of day trades within a short period. The trader must then prove they have sufficient funds to cover this strategy by depositing further capital. Any US broker that is regulated by FINRA will implement the pattern day trading rule. This includes brokers such as Questrade, eToro, and Robinhood. It is a legal requirement that they manage PDT on their platform.

Day Trading Patterns Every Day Trader Should Know

For day trading, small time frames are used to identify patterns, while investors focus on daily time frames or even the weekly or monthly chart. A Rising Wedge trading pattern forms off the reversal of a downtrend. A continuation chart pattern suggests that price will continue in the same direction after a high or low completes.

Should You Buy Aion (AION) Saturday? – InvestorsObserver

Should You Buy Aion (AION) Saturday?.

Posted: Sat, 15 Apr 2023 20:18:46 GMT [source]

Second, if you are new to these candlestick patterns, a simple way is to use a candlestick cheat sheet that lists all of them. The black one is bearish candle while the one on the right is the bullish candle. The black and white parts of the candles are known as the body while the two lines are known as shadows. The thinking behind this dogged effort to choose the right chart time frame or other trading parameter is faulty. It’s that each trading system or technique—and probably every market, too—has one optimal time frame or other variables that it will work best with.

If your account value falls below $25,000, then any pattern day trader activities may constitute a violation. As a pattern day trader, she could be eligible to purchase up to four times her maintenance margin excess, or $20,000 worth of stock. This is double the amount that an average margin account holder with the same balance and equity could trade, which is typically two times maintenance margin excess, or $10,000. A pattern day trader is a regulatory designation for those traders or investors who execute four or more day trades over the span of five business days using a margin account. The number of day trades must constitute more than 6% of the margin account’s total trade activity during that five-business-day window.

The picture below shows the https://forex-world.net/ation of a resistance level and rising lows, after which there was an impulse breakout of quotes and price consolidation above the resistance. After retesting the level, there was an opportunity to open a buy position with the target at the height of the formed triangle. Stop loss in this case is placed below the broken resistance line at the distance of the low of the impulse candle. The cup and handle chart pattern is a continuation of an primary trend in the upward direction, however, it can also be a bearish trend reversal chat pattern.

I’m going to teach you several different types of patterns including Consolidation Patterns, Structural Patterns, and Candlestick Patterns. Often times in the morning, the market does not afford you the luxury of resting on your laurels. If you time it just right, the gains will come swiftly as everyone is tripping over himself or herself to exit the position. In the above example, MMSI ran straight up into the 10 am time slot.

What do candlestick patterns tell you?

In the example below I enter after confirmation and place my stop just above the most recent resistance level of the wedge. After a strong downtrend you wait for the pennant shape to form. If I leave the stop where it is, the pattern completes beautifully and both targets are reached. Price eventually breaks the resistance at A and continues to fall. Once a rounding bottom has completed, wait for a small pull back. The lower lows and lower highs create the support and resistance .

The trade shown in figure 4 would not work for an anticipation strategy, since the price broke higher before coming back to touch the recently drawn support line. Figure 5 on the other hand, shows the anticipation strategy in action. At the completion of the handle there is a chance of a breakout to the low-side creating new lows. The seller volume begins to increase as the breakout occurs.

Trend continuation patterns can be a powerful tool in day trading, but it is important to remember that the stock market is always changing and evolving. Therefore, to stay ahead of the curve, traders must also consider trend consolidation patterns as part of their analysis strategy. A bullish flag is a bullish chart pattern that occurs when an asset experiences a sharp price increase, followed by a period of consolidation.

These lower highs and lower lows create support and resistance levels. This is a bullish day trading pattern, suggesting price will break resistance levels. The breakout tends to occur when support and resistance become narrow. These trading graph patterns create well established support and resistance levels.

‘Pigs get slaughtered’ –When you’re in a winning position, knowing when to get out before you get whipsawed or blown out of your position isn’t easy. Tackling your own greed is a hurdle, but one you must overcome. Genetic and Neural Applications –Profit from neural networks and genetic algorithms to better predict future price movements. Signals – Many service providers now offer reasonably priced trading signals. Profit/Loss ratio – Based on a percentage basis, this is the measure of a system’s ability to generate profit instead of loss. Beta – This numeric value measures the fluctuation of a stock against changes in the market.